Year-End Income Tax Planning in 2023

- Changes to retirement plan rules in the SECURE 2.0 Act of 2022 may benefit Bessemer clients.

- The year has also brought several developments on the enforcement front, including a heightened focus on higher income taxpayers and guidance on reporting cryptocurrency transactions.

- In this Wealth Planning Insights, we review recent tax developments and offer several tax planning strategies worth considering as the year comes to a close.

Signed into law in late December 2022, the SECURE Act 2.0 contains several changes to retirement plan rules that may benefit Bessemer clients. There was also some tax news on the enforcement front this year, including an initiative to increase scrutiny of higher income taxpayers and IRS guidance on the tax reporting of cryptocurrency transactions.

In the following pages, we will review these items briefly before highlighting a number of tax planning strategies and reminders to consider as we approach year end.

SECURE Act 2.0

Prior to this legislation, the requirement for minimum distributions (RMDs) from retirement accounts commenced at age 72. Beginning in 2023 the starting age for RMDs increases to 73, and it is further increased to 75 in 2033. This results in a longer period for tax-deferred asset growth in retirement plans.

In addition, to address a concern over excess or leftover balances in 529 plans, which provide a tax efficient way to accumulate funds for education expenses, the SECURE Act 2.0 includes a new provision allowing for a rollover of funds to a beneficiary’s Roth IRA. The same annual Roth IRA contribution limitations will apply, in addition to a $35,000 lifetime limit. The 529 plan will need to have been in place for at least 15 years to qualify.

IRS Funding Increase

The Inflation Reduction Act of 2022 included an $80 billion increase in IRS funding, much of it slated for heightened enforcement efforts targeting higher income taxpayers. Although this amount was reduced by more than $20 billion as part of the debt ceiling agreement between President Biden and former Speaker McCarthy, higher income taxpayers should still expect a greater degree of scrutiny, especially those with complex tax structures involving multiple flow-through entities. The IRS also announced plans to audit 75 large partnerships, including hedge funds and professional firms.

Cryptocurrency

The IRS has significantly increased its scrutiny of cryptocurrency and other digital currency transactions in recent years, and this trend will accelerate this year and beyond. The agency is paying close attention to the tax implications related to the dealing in digital currencies, including non-fungible tokens (NFTs). Significant updates are noted below:

- Earlier this year, the IRS issued preliminary guidance on the tax treatment of NFTs. These will be treated as collectibles for tax purposes such that a tax rate of 28% will apply to any long-term capital gains. This is higher than the maximum 20% capital gain tax rate that applies to other assets.

- Cryptocurrency is treated as property for tax purposes such that gains or losses from its sale or exchange are subject to capital gains tax. One important difference is that the wash sale rules do not apply to cryptocurrency, so this may be a valuable asset for tax loss harvesting. The wash sale rules disallow losses where substantially identical securities were purchased 30 days before or after the date of sale.

- The receipt of cryptocurrency as compensation or for exchange of goods and services will be treated as if it were cash and taxed as ordinary income.

Year-End Planning Considerations

The next major set of tax law changes are not scheduled until the end of 2025, when the individual tax provisions from the Tax Cuts and Jobs Act (TCJA) are set to expire.

Year-end income tax planning is still important when significant tax law changes are not imminent. Several effective strategies are detailed below.

TCJA Provisions Scheduled to Expire 12/31/2025

- Reduced individual top tax rate of 37%

- Increased AMT exemption and phaseout threshold

- Increased standard deduction

- Suspension of Pease provision, an income-based reduction in allowable itemized deductions

- $10k cap on state and local tax deduction

- Suspension of miscellaneous itemized deductions

- 20% qualified business income deduction

- Suspension of limitation on mortgage and home equity interest

- 60% AGI limitation on cash contributions to public charities

- Increased estate and gift tax lifetime exemption

Tax Loss Harvesting

It is often beneficial to recognize losses within an investment portfolio to offset current-year realized taxable gains. Short-term gains are subject to a combined federal and net investment income tax rate that can be as high as 40.8%, so these may warrant special attention. Losses from cryptocurrency investments can be used to offset other portfolio gains.

Care should be taken when exiting and reinitiating positions in substantially identical securities. The wash sale rule disallows losses where substantially identical securities are purchased 30 days prior to or following the date of sale.

To the extent you have any capital loss carryforwards, these should be factored into your year-end planning as well.

Tax benefit: Reduced current-year tax liability on capital gains.

Charitable Gifts of Long-Term Appreciated Securities

We recommend clients use long-term appreciated securities (LTAS) for charitable giving. A tax deduction is allowed for the full fair market value of securities donated to charity without triggering recognition of the embedded taxable gain. To qualify as long term, the holding period must exceed one year.

As compared to cash, the economic value of appreciated securities is actually less than fair market value due to the associated tax burden on the appreciation. Nonetheless, the tax code provides a deduction equal to fair market value.

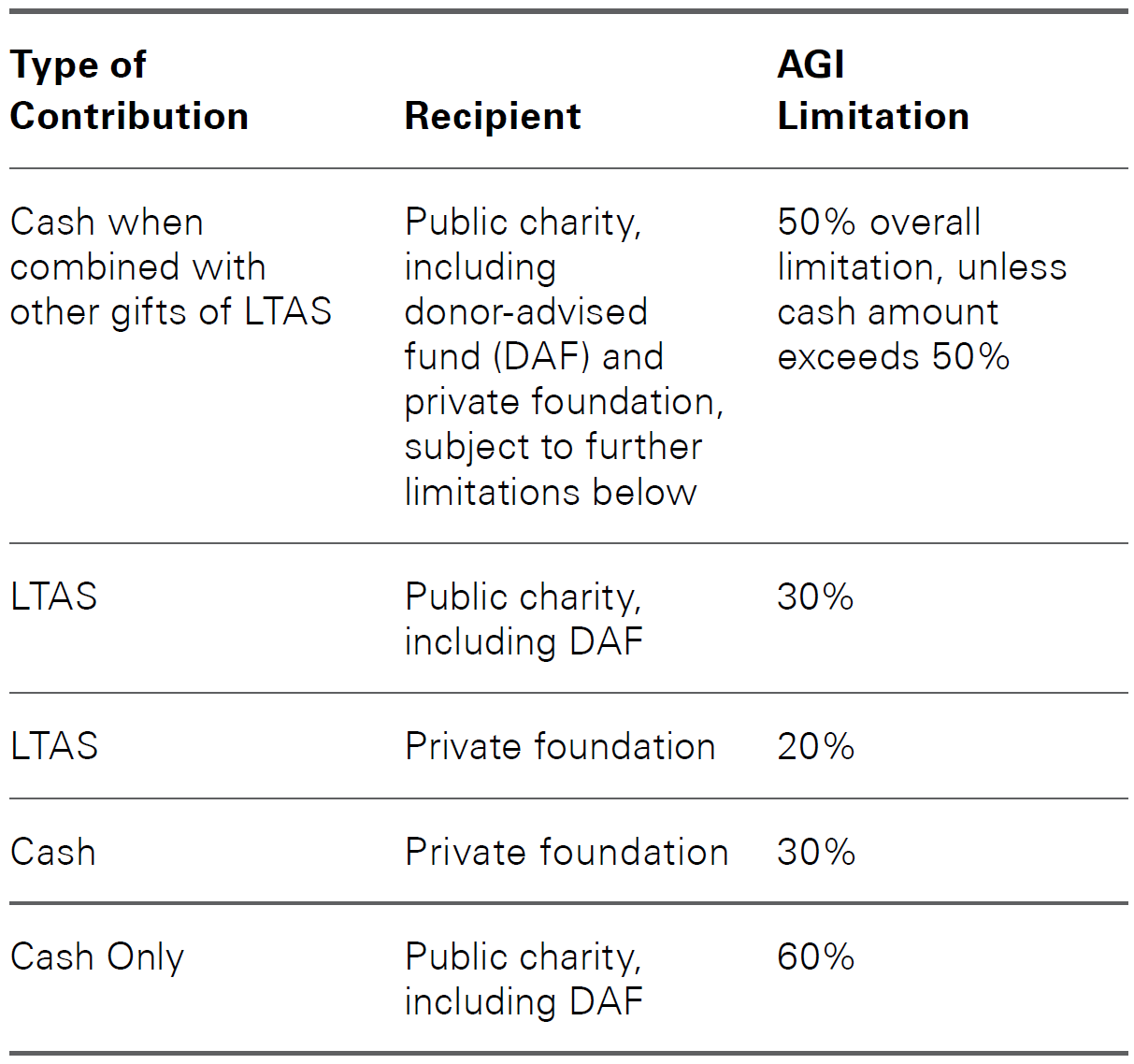

The amount of deduction allowed in any given year may be limited based on the type of contribution, the charitable recipient, and adjusted gross income (AGI). Excess amounts may be carried forward for five years.

Tax benefit: Allowable deduction exceeds actual economic value of donated securities.

Front-Loading Charitable Contributions

The TCJA increased the standard deduction for all taxpayers. In 2023, married taxpayers filing jointly will itemize if their total deductions exceed the standard deduction amount of $27,700. In certain situations, front-loading several years of charitable contributions, perhaps by using a donor-advised fund (DAF), can result in increased deductions over a multiyear period when combined with several years of claiming the standard deduction.

In this scenario, taxpayers could continue to make annual charitable contributions over several years with the amount front-loaded into their DAF.

Tax benefit: Increased level of total allowable deductions over a multiyear period due to the higher standard deduction. May also provide a charitable benefit at the state level.

Qualified Charitable Distribution (QCD)

Taxpayers aged 70½ and over can make distributions directly from their IRA to a qualified charity. The maximum distribution per year is $100,000 per individual, adjusted for inflation beginning in 2024. The QCD can be counted toward satisfying required minimum distributions, which begin at age 73 as of 2023. Since QCDs are excluded from income, no corresponding charitable deduction is allowed.

Adjusted gross income (AGI) will be reduced by the QCD such that limitations on other tax benefits tied to higher AGI levels may not apply. One such benefit is the 20% deduction for qualified flow-through business income.

Note that QCDs cannot be made to donor-advised funds or private foundations.

Tax benefit: Reduced AGI may yield larger allowable deductions.

Self-Employed Retirement Plans

Many individuals report net self-employment income as part of their yearly tax filing. This can include items such as consulting or directors’ fees, and the amounts are often substantial. A frequently overlooked tax planning opportunity is a self-employed retirement plan. Contributions can be made to these plans based on the amount of net self-employment income. Not only are these contributions tax-deductible — providing an immediate tax benefit — but the funds will grow in a tax-deferred account until withdrawn in retirement.

One such plan, the solo 401(k), allows for surprisingly large tax-deductible contributions. Depending on the level of self-employment income, annual contributions in excess of $60,000 may be allowed.

Retirement plan contributions need not be made by the end of 2023. Depending on the type of plan chosen, the funding can be made as late as the filing of your extended tax return, up to October 15, 2024.

Tax benefits: Current-year tax deduction; multiple years of tax-deferred growth; future Roth conversion opportunity.

Roth IRA Conversion

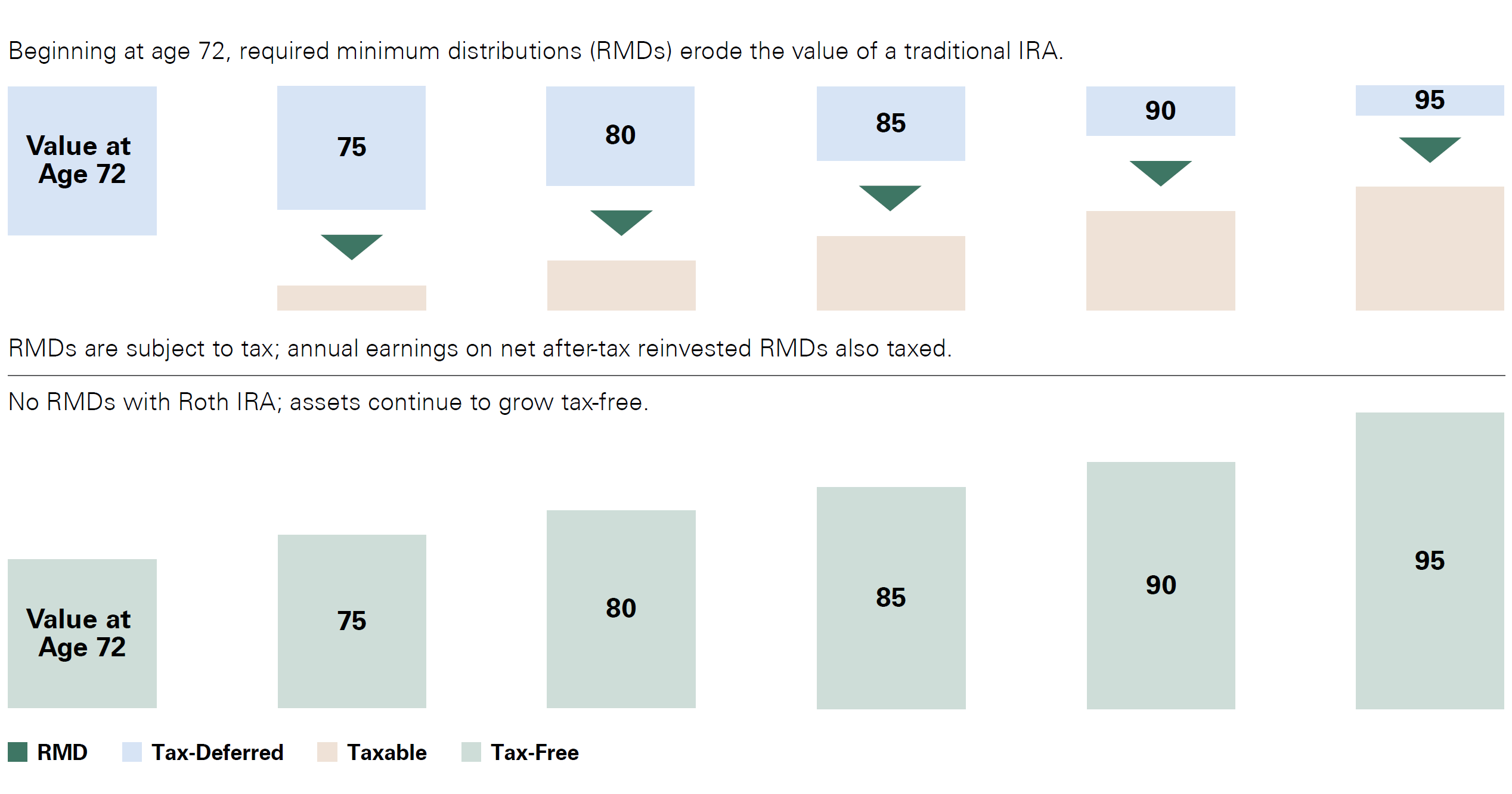

Roth IRAs provide an array of valuable tax benefits. All appreciation and income earned in the account is tax-free, and all qualified distributions are excluded from income. Further, there are no required minimum distributions (RMDs) for the owner or spousal beneficiary. (Except in certain situations, non-spouse beneficiaries must distribute the account fully within 10 years.)

Compare this to a traditional IRA, where income is tax-deferred but RMDs do apply beginning at age 73 and distributions are treated as ordinary income, potentially subject to tax at the highest marginal rate. Converting a traditional IRA into a Roth can be a compelling opportunity, especially if the associated tax cost can be reduced or fully offset.

The tax treatment of a Roth conversion is simple. The amount converted must be included in taxable ordinary income in the same tax year. One strategy to reduce the tax cost is to convert in a tax year where a large charitable contribution is planned. By offsetting income recognized on the conversion, the charitable deduction effectively reduces the tax cost involved.

Another opportunity involves utilizing suspended passive activity losses. In the year of disposition of a passive investment, suspended losses associated with the investment become deductible and can be used to offset the ordinary income connected with a Roth conversion.

Tax benefits: Tax-free income and distributions with no RMDs for owner and spousal beneficiary; tax-free distributions for non-spouse beneficiaries; potential for reduced tax cost on conversion.

Exhibit 1: Traditional IRA vs. Roth IRA

Beginning at age 72, required minimum distributions (RMDs) erode the value of a traditional IRA. RMDs are subject to tax; annual earnings on net after-tax reinvested RMDs also taxed. No RMDs with Roth IRA; assets continue to grow tax-free.

Backdoor Roth Conversions

The so-called “backdoor” Roth conversion is an effective strategy to add to a Roth IRA balance. While there are income limits on direct funding of Roth IRAs, a taxpayer with earned income can bypass these restrictions by setting up and funding a non-deductible IRA and then converting the account to a Roth account shortly thereafter. Because it was a non-deductible IRA with no appreciation, there is no tax cost on the conversion. This strategy only works where the taxpayer has no existing traditional IRAs.

The maximum yearly IRA contribution for 2023 is $7,500 if the taxpayer is age 50 or older ($6,500 if younger than 50). Similar amounts may be contributed for spouses even if they have no earned income.

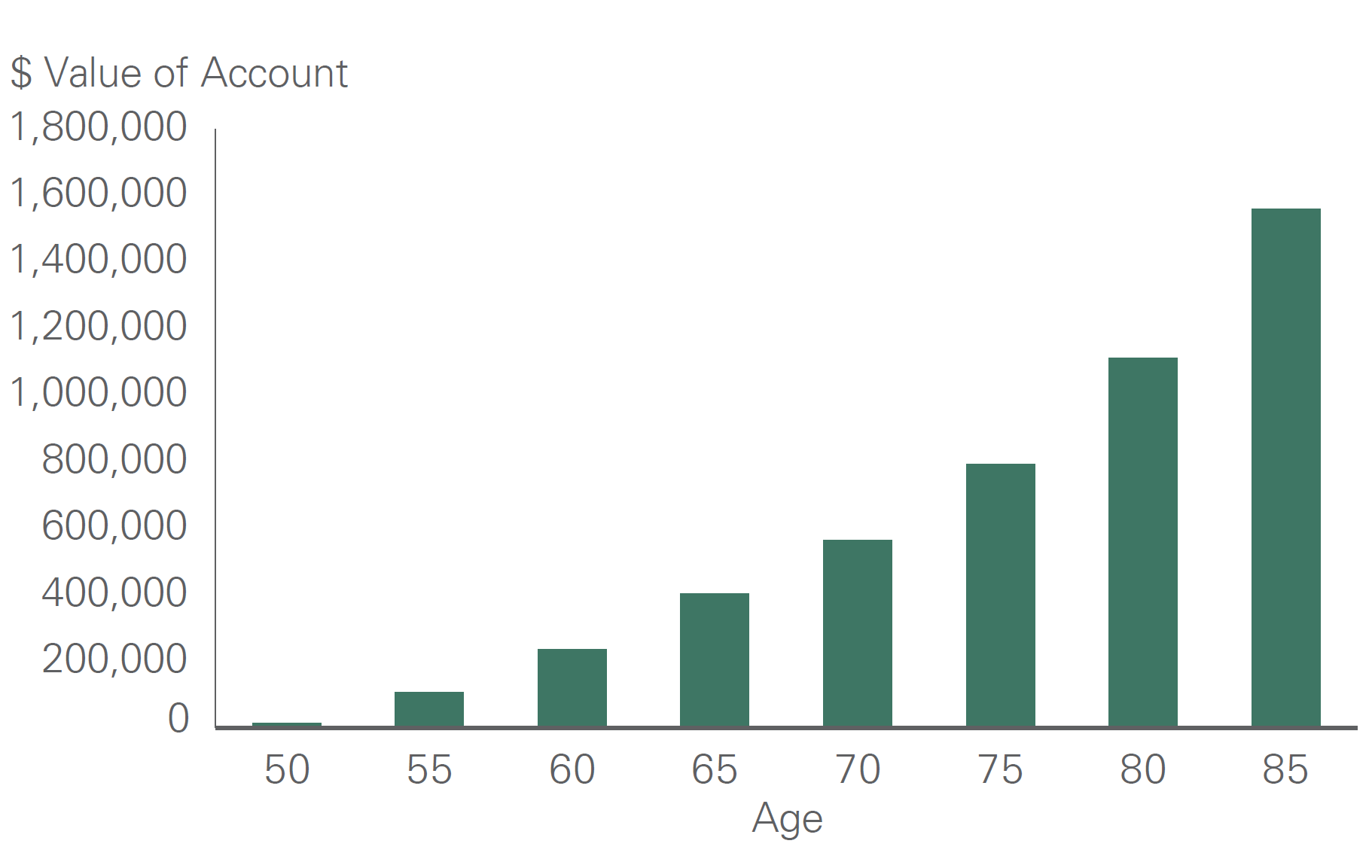

As seen in Exhibit 2, a married couple aged 50 contributing $15,000 per year for 15 years would have Roth IRAs totaling more than $1.6 million at age 85.

Tax benefits: Tax-free income and distributions with no RMDs for owner and spousal beneficiary; tax-free distributions for non-spouse beneficiaries.

Annual Exclusion Giving

For tax-year 2023, every individual is entitled to give $17,000 ($34,000 for married couples) to any number of individuals without reducing their remaining lifetime gift tax exemption. While annual exclusion giving should always be coordinated with the overall estate plan, two strategies can provide significant income tax benefits as well:

529 plans. Congress established 529 plans to encourage saving for future education costs. The vast majority of states sponsor these plans, and most will provide at least a partial annual state income tax deduction for amounts funded, effectively paying people to save for college. A donor can front-load up to five years of annual exclusion gifts to a 529 plan in one tax year.

If account withdrawals are used for qualifying education expenses, the account earnings will never be subject to income tax. Although direct payments of tuition are not treated as taxable gifts, 529 plan distributions can be used for expenses beyond tuition, such as room and board, computer equipment, books, fees, and supplies. Additionally, up to $10,000 per year can be applied toward private elementary or secondary school tuition expenses.

Tax benefits: State tax deduction; tax-free earnings and distributions when used for qualifying education expenses.

Roth IRA for children. Parents may wish to fund Roth IRA contributions for children as part of an annual giving strategy. Provided that children have earned income, perhaps from a summer job or other employment, Roth IRA contributions are permitted, but limited to the lesser of earned income or $6,500. For adult children with income exceeding $153,000, the backdoor Roth strategy should be considered.

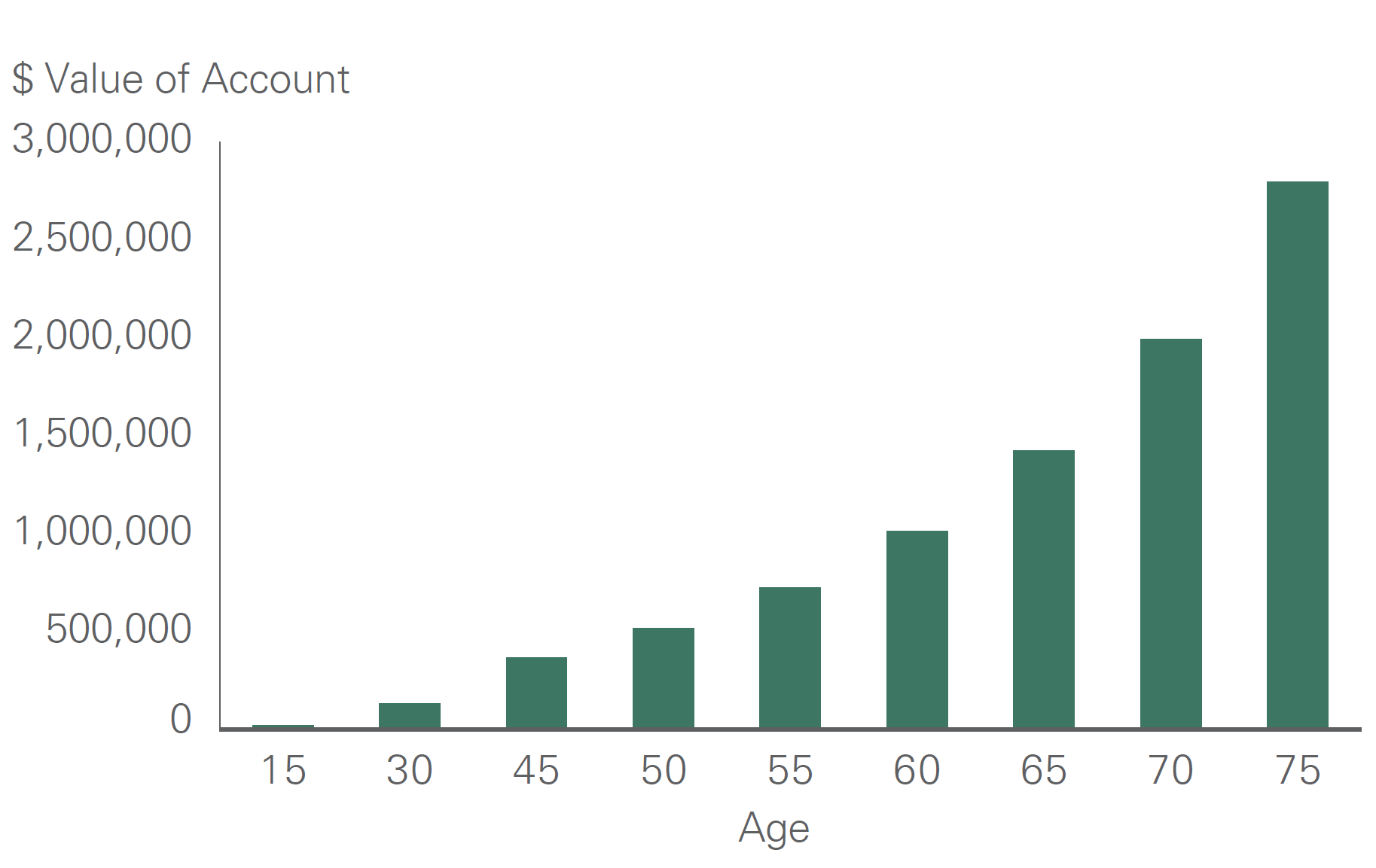

Exhibit 3 shows the long-term value of funding Roth IRAs for children. A Roth IRA is funded with $6,500 each year for 10 years beginning at age 15. There is no funding beyond that. At age 75, the account has grown to more than $3 million.

Tax benefits: Tax-free income and distributions with no RMDs for owner and spousal beneficiary; tax-free distributions for non-spouse beneficiaries.

Summary

The tax planning strategies discussed above may not provide significant tax benefits in a single year. However, if they are consistently applied on an annual basis, the long-term economic value can be quite substantial.

We hope this discussion has been helpful. If you have any questions, please contact your client advisor or one of our senior tax advisors.

The information and opinions contained in this material were prepared by Bessemer Trust, and is for informational purposes only. It does not take into account the particular investment objectives, financial situation, or needs of any individual client. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Bessemer Trust does not provide legal advice. Please consult with your legal advisor to determine how this information may apply to your own individual situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared.