Revolutionizing Manufacturing:

The Role of Industrial Automation

- Shifts in demographic trends, recent government legislation, and technological advancements support the continued adoption of industrial automation technology.

- While increased use of industrial automation could present challenges, we don’t believe it is likely to create widespread job losses.

- There are exciting investment opportunities in both public and private portfolios that we believe will benefit from the longer-term growth in industrial automation.

An aging population, recent legislation focusing on domestic manufacturing, and technological advancements requiring increasingly complex and precise tools have incentivized businesses to increase investment in industrial automation technology. This technology aims to improve productivity, quality, and safety by allowing companies to perform accurate and continuous operations without breaks, which often results in faster production cycles.

In this Investment Insights, we examine the ways industrial automation is likely to impact individual companies and the broader economic landscape. Exciting investment opportunities lie ahead as many companies will benefit from automation technology to enhance productivity and profitability.

Background

Industrial automation is the creation and application of technology with the goal of reducing human intervention in manufacturing processes, and it’s not particularly new. In fact, it can be traced back to the Industrial Revolution (Exhibit 1); one of the earliest examples of industrial automation was the automated flour mill. Since then, the process of electrification and eventually the use of computers and robotics have allowed for improved productivity, accuracy, and safety in production quality. Across the industrial automation landscape, end-market demand comes from a range of industries including the automotive, consumer goods, semiconductors, electronics, and oil and gas industries.

Industrial automation generally creates operational efficiencies that lead to increased productivity. For example, Amazon has over 750,000 robots working with its employees throughout its operations. These robots free workers from highly repetitive tasks and allow Amazon to list items for sale on its website and deliver packages to its customers at a faster pace.

Exhibit 1: A Brief History of Industrial Automation Technology

Key takeaway: Industrial automation technology has been progressing steadily since the Industrial Revolution.

Source: Bessemer Trust

Industry Tailwinds

Tailwinds for the industrial automation industry include shifts in demographic trends, government policies emphasizing domestic manufacturing, and technological advancements that support the inexorable advance of industrial automation.

While industrial automation is not immune to cyclical headwinds, as slower growth and higher interest rates may cause companies to delay or reduce spending for automation projects, the long-term outlook remains positive. The global industrial automation market is projected to grow 8.9% on an annualized basis, more than doubling from $202 billion in 2022 to $474 billion by 2032, according to average market research firm estimates.

Demographic impacts. Many of the largest and most advanced economies, including the U.S., Europe, China, and Japan, are confronting demographic shifts, notably a growing proportion of elderly individuals. While a shrinking workforce and aging population increasingly strain labor force dynamics, these challenges also present incentives for innovation and automation and are pushing many industries to invest in new technology.

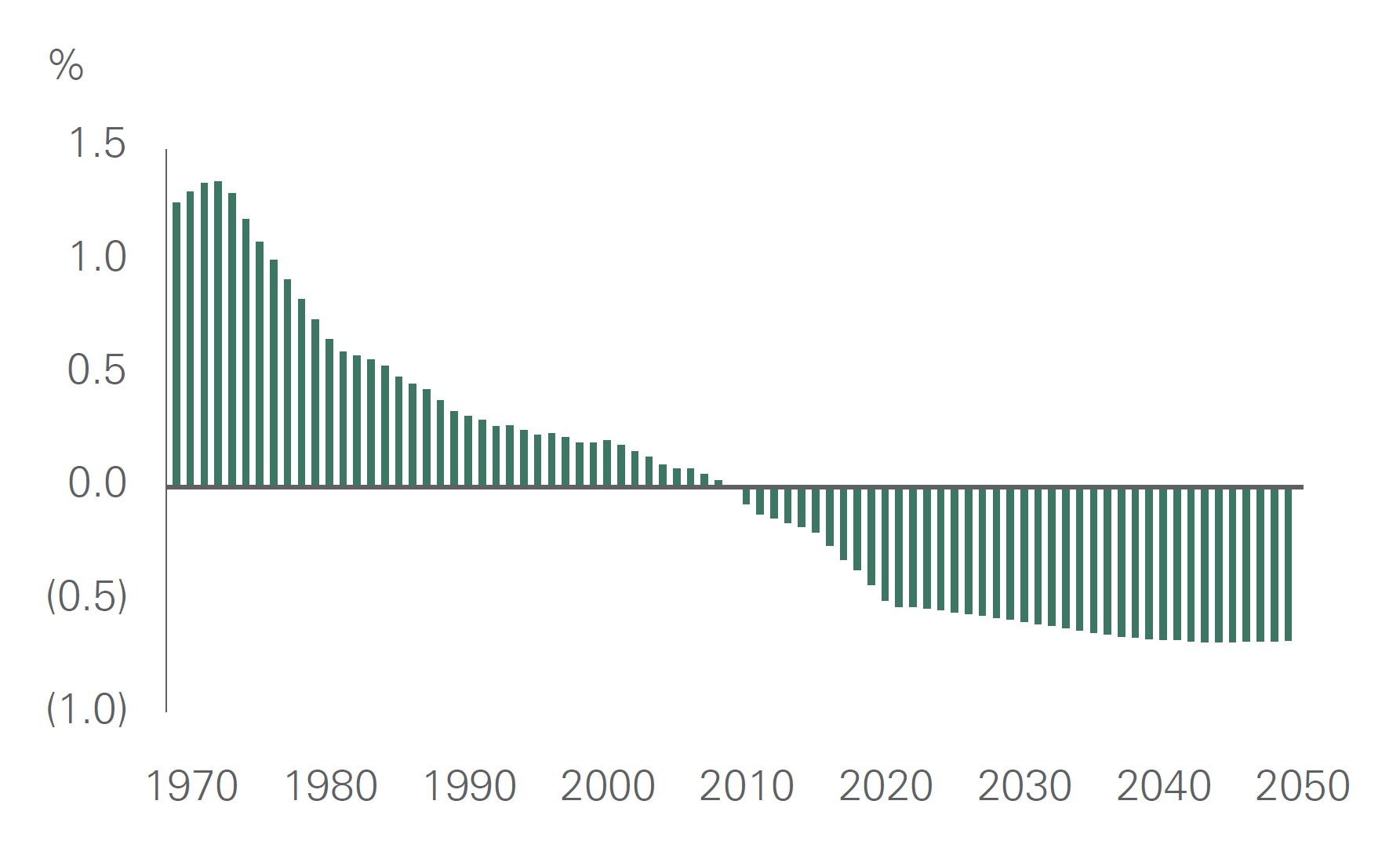

A key example is Japan, which has seen the combination of a decline in the labor force in conjunction with a limited influx of foreign workers create an incentive for increased adoption of automation technology. The total Japanese population reached a peak of 128.1 million people in 2010 before starting to decline (Exhibit 2). Japan has a low fertility rate in addition to one of the highest life expectancies in the world. With an aging population and limited fertility, the percentage of the population above the age of 65 has been increasing over the years — it recently reached 30% (compared to a global average of 10%) and is projected to keep rising. Additionally, Japan’s strict immigration restrictions for foreign workers limit its ability to increase its labor supply.

Given these demographic headwinds, Japanese companies have invested in automation and robotics that replace or enhance human labor. The International Federation of Robotics estimates that Japan’s robot density, a key indicator of automation adoption in the manufacturing industry globally, is one of the largest in the world with 399 robots installed per 10,000 employees (compared to a global average of 141 robots installed per 10,000 employees).

Exhibit 2: Japanese Population Year-over-Year Growth Rate

Key takeaway: Japanese population growth peaked in 2010 and has since declined.

Source: United Nations Population Division

U.S. government policies. Increased manufacturing production supports the continuous advance of industrial automation. Recently, large fiscal support in the U.S. has been aimed at industrial policy accelerating domestic manufacturing in key industries. The specific policies, including the CHIPS Act, Inflation Reduction Act (IRA), and Infrastructure Investment and Jobs Act (IIJA), aim to provide the U.S. with a competitive edge in secular growth industries, such as semiconductors and electric vehicles, as well as revitalize domestic infrastructure. Moreover, with supply chain resilience top of mind for many countries and companies, investment in diversifying supply chains is increasing. After the pandemic, many countries and companies realized that they cannot be over-reliant on one region for supplies.

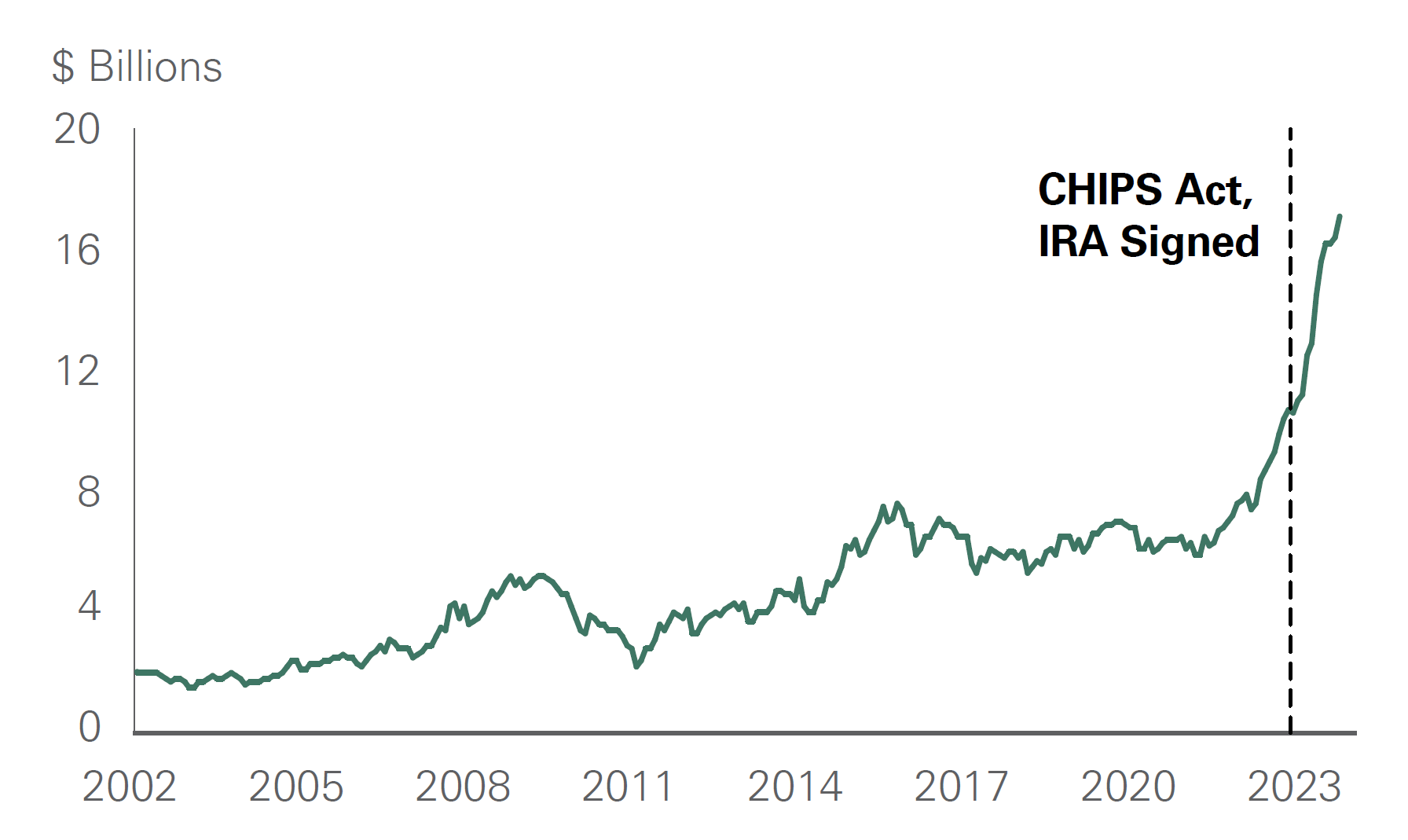

Nonresidential construction in the U.S. has benefited from government-related infrastructure policies. Increased nonresidential construction provides support for manufacturing technologies given the need to increase productivity, quality, and safety in industrial operations. Notably, nonresidential private construction growth in computer, electronic, and electrical facilities has boomed, likely due to the recent legislation (Exhibit 3). Since the CHIPS Act was enacted in August 2022, over 60 new semiconductor ecosystem projects have been announced across the U.S.

The growing number of semiconductor factories in the U.S. — combined with a relatively small penetration of semiconductor companies that use artificial intelligence (AI) or machine learnings (ML) at scale — provides investment opportunities. According to a McKinsey survey, just 30% of semiconductor companies currently use AI or ML at scale to increase automation capabilities. We believe many companies will benefit from automation through increased efficiencies or increased demand for needed parts, including robotics and sensors or factory software. For example, Bessemer holding KLA Corporation has products that utilize AI and ML to increase the efficiency and output of semiconductor manufacturing processes.

Technological advancements. New technologies requiring increasingly complex and precise tools have helped drive growth for industrial automation adoption. One of the key benefits of automation technology is the ability to consistently ensure accurate results and reduce the risk of human error. For example, the world is digitalizing, and demand for semiconductors has grown immensely — the global semiconductor industry now ships over a trillion semiconductor units annually. Semiconductor manufacturing has grown increasingly complex and challenging as semiconductor chips have become smaller and more sophisticated. It is critical for semiconductor manufacturers to ensure that their chips are produced accurately and predictably, and semiconductor fabrication plants incorporate automation technology to ensure these outcomes. As technology evolves as the world continues to digitalize, manufacturers will continue to utilize automation technology to improve their manufacturing processes.

Exhibit 3: Total U.S. Nonresidential Private Construction – Manufacturing

Key takeaway: Nonresidential private growth in manufacturing has boomed in accordance with the recent legislation.

Nonresidential private growth in manufacturing has boomed in accordance with the recent legislation.

Source: U.S. Census Bureau

Bessemer Investments in Industrial Automation

Bessemer’s All Equity Portfolio is invested in companies that we believe will benefit from the longer-term growth in industrial automation, including Honeywell International and Keyence Corporation.

Honeywell International is a leading technology and manufacturing company that provides, among many other things, sensors and switches to improve productivity, sustainability, and safety in factories for high-growth businesses. Moreover, Honeywell serves a variety of industrial end markets, including aerospace, oil and gas, mining, and warehousing. For example, the company offers robotic arms and machines designed to pick, pack, and place items, and the machines are often integrated with machine learning for improved efficiency.

Similarly, Keyence is at the forefront of factory automation, supplying sensors, measuring systems, laser makers, and microscopes to factories across a variety of end markets.

Both companies serve customers across the U.S. and internationally, including Europe and Japan. Bessemer’s internal and external portfolio managers believe that both Honeywell and Keyence have favorable long-term outlooks, in part due to the increasing use of automation technology globally.

In private markets, industrial automation has been a theme in focus for several years. Several underlying managers believe that autonomous systems will be a driving force behind physical industries going forward. Eclipse Ventures, a venture capital manager that Bessemer’s private equity program has backed since 2016, is dedicated to the transformation of traditional industries — what it calls “the Industrial Evolution.” Eclipse is led by investors who have spent years as senior operators on the leading edge of manufacturing and automation, building cars, semiconductors, consumer electronics, and more.

Their experience has led them to back innovative companies such as Augury, which provides up-to-date insights into the health of a manufacturing company’s machines using a combination of hardware and software. Augury’s solution seeks to optimize production and eliminate downtime in a factory.

Additionally, Bright Machines is an Eclipse-backed company automating many facets of electronics assembly lines. For example, its modular and flexible solutions are being used to assemble cloud computing infrastructure including server racks, creating a more resilient supply chain closer to customers.

Finally, industrial automation has the potential to greatly expand access to cutting edge cell therapies, which currently are extremely expensive and time consuming to manufacture. Cellares is an Eclipse company automating the cell therapy manufacturing process and is poised to broaden access to life-saving treatments as a result.

Economic Challenges and Opportunities

While increased use of industrial automation technology could present challenges such as job displacement, it is unlikely to create widespread job loss, in our view. Historically when the workforce is confronted with new automation technology, workers shift to new or other jobs or spend time on tasks in their current roles that have not been automated. Furthermore, the increased use of automation technology should help provide productivity gains for the economy in the years ahead.

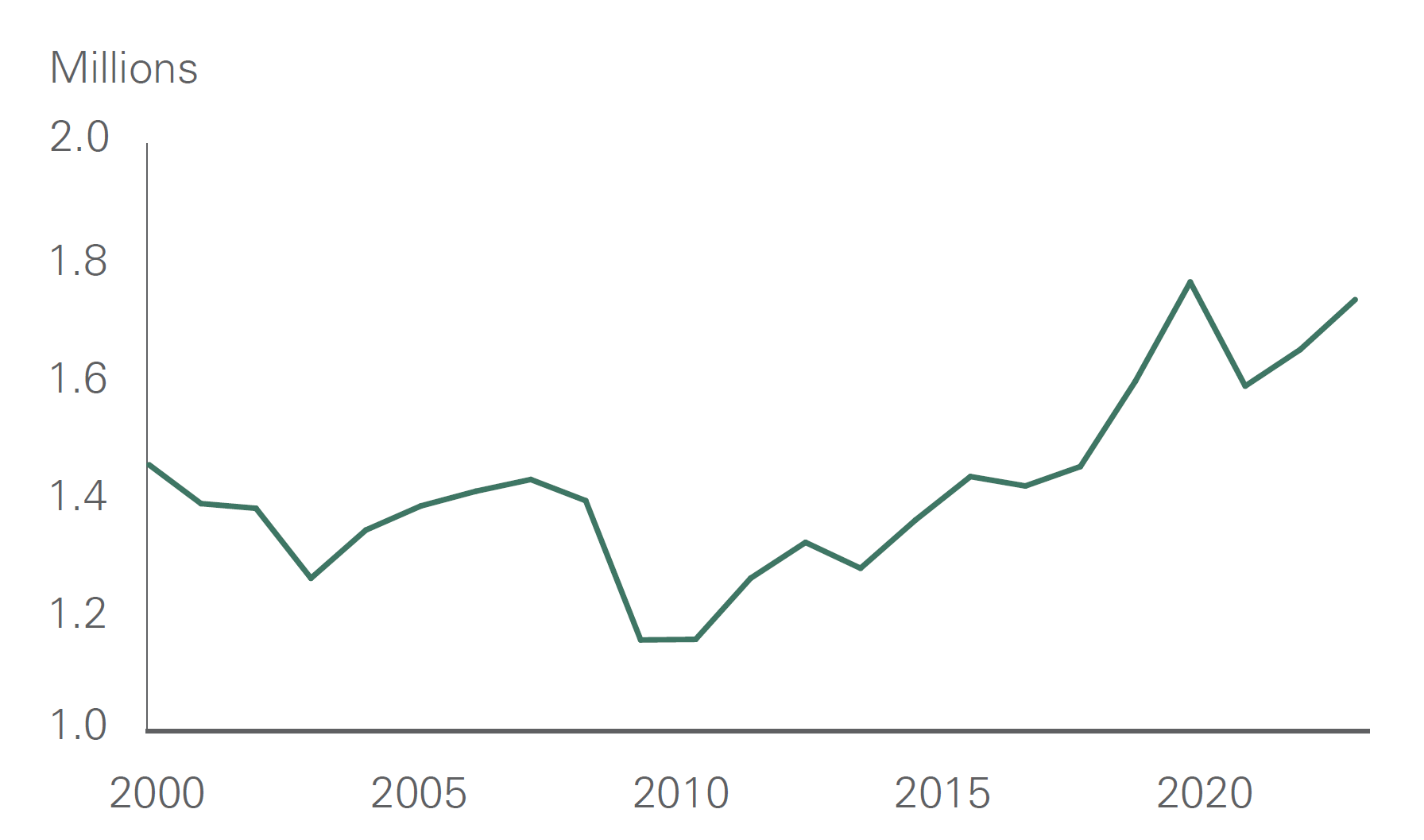

Job loss concerns. Growth in automation technology has attracted attention due to the possibility of increased job displacement; however, technological innovations could increase demand for products and require more employees to meet that demand, working side by side with the technology. We have seen this phenomenon historically. For example, automation was expected to significantly decrease the number of stock-handling jobs in warehouses in the prior decade, given increased use of robotics in warehouse operations. The Bureau of Labor Statistics (BLS) initially projected a period of negative employment growth for stock-handling jobs from 2008 through 2018. However, in contrast to these initial estimates, the occupation grew over the period, driven primarily by the growth of e-commerce (Exhibit 4).

Exhibit 4: Full-Time Stock-Handling Workers

Key takeaway: The number of stock-handling jobs in warehouses grew over the prior decade, reflecting the growth of e-commerce.

The number of stock-handling jobs in warehouses grew over the prior decade, reflecting the growth of e-commerce.

Source: Federal Reserve Economic Database

Fears that automation will cause widespread job losses have been raised repeatedly in the past, but growth of automation technology does not necessarily imply large job displacement. Though automation may reduce the number of jobs in some occupations, such as telemarketers or tractor operators, with the advance of artificial intelligence and autonomous vehicles, historically, the workforce has shifted to other or new occupations. Increased automation of tasks within occupations may result in more time spent on other (perhaps new) tasks without a necessary reduction in the number of jobs. Moreover, as shown in the warehouse and robotics example above, the growth of product demand within industries implementing new technology can buffer the employment effects of technological change. On a broader scale, population growth and economic growth are associated with expanding employment. It is also possible that adoption rates for new production technology are more gradual than commonly assumed.

Productivity improvements. Increased use of automated manufacturing technology should provide productivity gains in the years ahead, which could help offset labor force headwinds stemming from negative demographic shifts. As an example of productivity gains, manufacturing sector productivity has historically outperformed service sector productivity over the past decade in Japan, with productivity higher in manufacturing sectors that incorporate a large amount of automation technology. While there are a myriad of reasons for the gap between manufacturing and services productivity, the manufacturing sector has likely benefited from increased adoption of industrial automation technology. Moreover, specific areas, including electronic parts and devices production, which is reliant on automation technology, have seen particularly strong productivity growth over the past decade. Further adoption of this technology should support productivity gains and help offset demographic headwinds in the years ahead.

Conclusion

We expect the global industrial automation market to expand as infrastructure legislation, energy transition, grid modernization, and demographic trends continue to drive automation technology demand over the longer term. While there are fears that automation will cause widespread job displacement, historically, many researchers have overestimated the scale of actual displacement. Moreover, we believe that automation will increase productivity gains for nations going forward.

Amid several structural tailwinds in the industry, Bessemer maintains investments that we believe will benefit from the rise in industrial automation on both the public side and private side. Bessemer’s All Equity portfolio is overweight the industrial sector and is primarily exposed to companies with exposure to secular drivers.

Past performance is no guarantee of future results. This material is provided for your general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. This material has been prepared based on information that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. This presentation does not include a complete description of any portfolio mentioned herein and is not an offer to sell any securities. Investors should carefully consider the investment objectives, risks, charges, and expenses of each fund or portfolio before investing. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. The mention of a particular security is not intended to represent a stock-specific or other investment recommendation, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference. Index information is included herein to show the general trend in the securities markets during the periods indicated and is not intended to imply that any referenced portfolio is similar to the indexes in either composition or volatility. Index returns are not an exact representation of any particular investment, as you cannot invest directly in an index. Alternative investments, including private equity, real assets and hedge funds, are not suitable for all clients and are available only to qualified investors.