A Guide to Effective Family Meetings

- Family meetings — unlike social gatherings — have a clear structure and purpose and often benefit from the guidance of a skilled third-party facilitator.

- These gatherings can be an effective tool for families, fostering financial literacy, aligning generational values, and creating opportunities to share and discuss important aspects of family wealth.

- Bessemer’s experienced specialists work closely with families to create the right conditions for successful family meetings through thoughtful planning and custom strategies that support productive dialogue, learning, and positive long-term relationships with wealth.

In recent years, families, including many Bessemer client families, have been changing the way they gather.

Not your typical social events, family meetings have a specific structure and purpose. They provide opportunities for meaningful interaction and progress on wealth management and other family matters. They can also bring families closer together in ways that foster emotional and intellectual capacity and resilience — both individually and collectively. In our experience, families that communicate on these topics with purpose tend to have more positive experiences with their wealth.

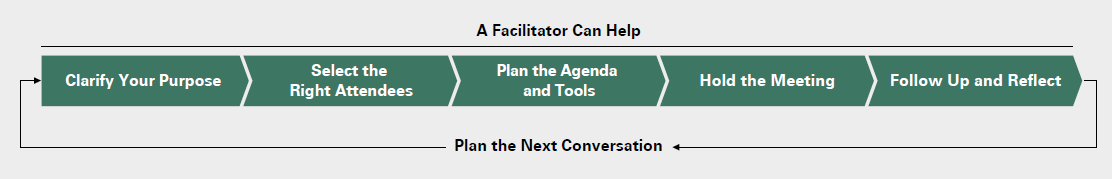

We explore Bessemer’s perspective on family meetings — what they are (and are not), their potential benefits, how to plan and structure them effectively, and the kinds of approaches we have found lead to the most fruitful discussions (Exhibit 1). We’ll also share how Bessemer can support you in making these meetings a valuable part of your family’s journey.

What Are Family Meetings?

As we practice them at Bessemer, family meetings tend to be regular, structured, and intentional, and they often include a skilled third-party facilitator. They can be included as part of social family gatherings — holiday celebrations, birthday parties, vacations, or similar occasions — but they don’t have to be.

Regardless of when or how these meetings take place, they are guided by a clear purpose, thoughtfully defined in advance through a collaborative process.

But what exactly is that purpose? It can vary widely based on the unique needs and goals of each family.

Are you disclosing certain aspects of your wealth plan? Introducing a new philanthropic initiative for your family to collaborate on? Discussing an emerging family dynamic that is weighing down the family’s ability to flourish?

The potential topics are many, and a facilitator can help you define the focus of your family meetings. These initial conversations typically occur with the wealth holder, but topics can emerge from other places — maybe someone is new to the family system, for instance — and other family members can provide valuable input.

Part of a successful family meeting is having the right attendees. They should reflect the goals of the meeting and support the family culture.

Experts from Bessemer and elsewhere can be included to facilitate the conversation, keep the meeting on pace and point, and discuss substantive topics, like investments or estate planning.

In terms of family members, while we generally recommend broad inclusion, some circumstances may warrant otherwise. If spouses or partners are to be included only on certain topics or at certain times of year, this expectation should be established from the outset. If there is a minimum age requirement to attend the meeting, it should be clearly communicated in advance.

On the other hand, if a family member is invited but is reluctant to attend, we typically recommend keeping the door open by continuing to send invitations in the hope that they will eventually become curious enough to attend.

Finally, there are instances where some family members need to resolve issues with each other before sitting down as a group. While families typically have an instinct for when it’s not yet time for a family meeting, that isn’t always the case, and Bessemer may be able to help you spot potential concerns that need addressing before a productive meeting can take place.

What to Expect From a Family Meeting?

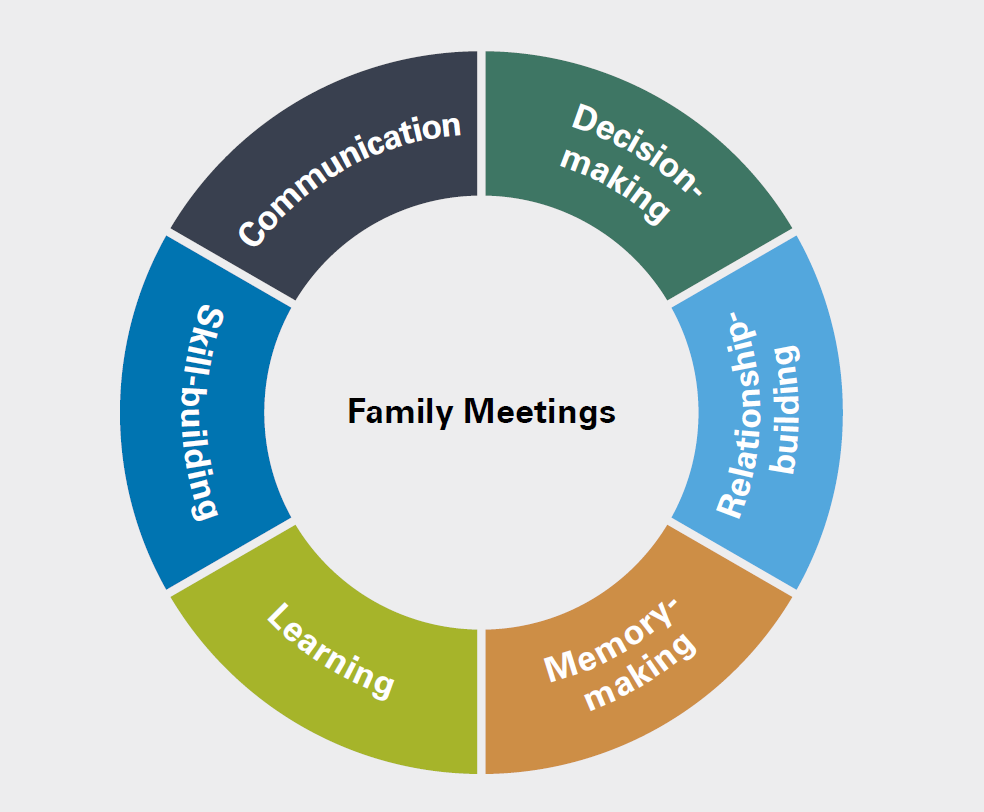

There are three types of family meetings we frequently facilitate, each with a distinct purpose. Even though a family meeting should have a main purpose, secondary objectives may also come into play, depending on a family’s needs and goals (Exhibit 2).

In addition, because every family is unique, the tools and approaches we use may vary — and can even be adapted during the meeting itself.

Families who hold regular meetings might also have developed their own tools and customs, which we wholeheartedly support.

1. Invest in Learning and Growth

We typically see a range of educational backgrounds, talents, and skill-sets in the families we serve. It’s therefore often important to level-set the financial and estate planning knowledge of family members over time. Even if advisors will be managing the family’s financial resources, family members should still grasp the fundamental concepts of investing and wealth preservation.

Everyone learns differently and, therefore, we conduct pre-meeting interviews to understand the best ways a family can learn together. We also leverage technology to make the learning engaging and easily accessible.

For example, Bessemer’s Across the Board video series explains key financial concepts through a life-stage lens, covering topics from budgeting to estate planning. These videos can serve as a refresher for all, with deeper dives available for those wanting more insight before the meeting.

2. Foster Multigenerational Relationships

Finding new ways for family members to interact across generations, family branches, and geographies can often be crucial for the family to have a positive relationship with their wealth and, indeed, to keep it in the family over time.

Bringing everyone together is a critical first step, but once everyone has gathered, how can you make the time together most impactful?

Family members can sometimes get stuck in their “assigned” childhood roles: “the artistic one,” “the shy one,” “the smart one.” To break these patterns, we use facilitative techniques including active listening, challenging assumptions, and fostering curiosity.

If a power imbalance exists, particularly with the wealth creator present, we apply strategies to level the playing field. Simple adjustments, such as randomizing seating to avoid hierarchical arrangements, can help.

As facilitator, we can encourage the entire group to see each other from different perspectives using a wide variety of tools. One activity helps family members identify their communication styles — such as fact-based “analyzers” versus intuitive “persuaders” — and adapt their approach for more effective and respectful conversations.

Another exercise explores individual values, highlighting shared principles across generations and family branches, reinforcing common ground. This can help family members get down to the proverbial “studs” to see past external differences and recognize fundamental bonds.

In some meetings, we flip the script and have the youngest generation lead discussions on topics such as artificial intelligence or philanthropic research. These activities promote mutual respect and encourage continued engagement in family conversations.

3. Disclosing Aspects of the Wealth Plan

If all or part of a wealth plan is to be shared during a family meeting or series of meetings, we recommend adopting a structured approach. Here is a suggested framework:

- Start with the “what” and “why.” Rather than beginning with numbers, start with the intent behind the wealth plan:

- The “what”: What do the wealth holders want their wealth to achieve for the family?

- The “why”: What life experiences and values shaped these decisions?

For example, perhaps the wealth holder(s) had to delay milestones due to financial constraints, such as paying off student debt, and want to ensure future generations won’t face the same challenge. Or they may see wealth as a safety net, informed by a financial setback they experienced. Others may value hard work and want to structure trust distributions to encourage financial independence. Some might wish to support family members in pursuing meaningful but lower-earning careers.

As a wealth owner, once you have your what and why, we encourage you to write them down and read them out loud at the start of the meeting. This personal introduction sets the tone and helps ground the discussion in shared values.

- Address “why now?” Clarifying why this conversation is happening now can be important, especially for younger generations. It could signal that you recognize their financial maturity and readiness to understand their role in the plan.

- Step through the technical details. A Bessemer advisor or estate planner can walk through key structures in your plan — such as business entities or trusts — explaining how they work in practice and what they mean for beneficiaries.

- Share the numbers thoughtfully. When revealing financial figures, consider presenting them as a range. Allow time for the beneficiaries to process this information. For example, they may not thank you right away. Schedule a follow-up meeting to revisit discussions and address any questions that arise.

Tips for Productive Family Meetings

Creating the right conditions for productive family meetings requires more than good food and engaging activities. Here are key strategies to keep in mind:

- Establish ground rules: At the start of every meeting, we suggest setting clear guidelines — such as limiting cell phone use and structuring when to ask questions. While it may sound counterintuitive, a defined structure enforced by an objective facilitator can create an environment where conversations can flourish.

- Emphasize active listening: Active listening goes beyond simply hearing words; it requires full engagement, empathy, and avoiding interruptions. This approach fosters open communication, reduces misunderstandings, and helps defuse tension. By ensuring that all family members feel heard, active listening becomes a crucial tool for productive discussions. Our facilitators can provide guidance in mastering these techniques.

- Be prepared for difficult conversations: Family meetings can touch on sensitive subjects, which can sometimes lead to conflict. A skilled facilitator can help navigate these moments, but building the family’s ability to engage in constructive dialogue is equally important. Establishing clear ground rules and practicing active listening are strong starting points. We also teach a number of other skills, including how to structure difficult conversations, how to adapt to different communication styles, and how to build consensus to ensure discussions remain productive and respectful.

- Advance preparation and post-meeting follow-up is essential: We’ve discussed key steps for planning a successful family meeting — setting a thoughtful agenda, inviting the right participants, establishing ground rules, and possibly working with a facilitator.

Equally as important is the work that follows. This includes creating and distributing detailed notes summarizing discussions, decisions, action items, or unresolved issues. Evaluation, reflection, and feedback from participants to improve future meetings should also be encouraged when setting future meeting topics.

How Bessemer Can Help

Regardless of the meeting’s purpose, each gathering should ideally deepen family connections, strengthen intellectual and emotional intelligence as a unit, and over time, increase a family’s ability to navigate life’s changes — along with the complexities that wealth can bring.

Since no two families are alike, a thoughtful, tailored approach to establishing family meetings is crucial. Our family governance specialists at Bessemer Trust partner with families at every step of the process. We work hand-in-hand with our clients and one another to shape agendas, identify appropriate subject matter experts, set expectations, and guide meetings toward successful outcomes.

If you’d like to learn more about family meetings, including whether one might make sense for your family, please contact your Bessemer advisor.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. The views expressed herein do not constitute legal or tax advice; are current only as of the date indicated; and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.