Choosing a Tax-Efficient Business Entity

- The Tax Cuts and Jobs Act of 2017 (TCJA) made sweeping changes to the federal tax code, including several major changes to the taxation of business income. The applicability of these rules varies based on the type of business entity involved.

- Choosing the best type of business entity for your company is more important than ever to maximize tax efficiency, but it can also impact the personal liability risk you may incur and your ability to raise money, among other important business considerations.

- In this A Closer Look, we focus on the tax and other consequences of various business entities and related planning opportunities for individuals.

The Tax Cuts and Jobs Act of 2017 (TCJA) made sweeping changes to the federal tax code. Many provisions focused on individuals, but several major changes affected the taxation of business income. In all cases, the applicability of these rules varies based on the type of business entity involved. It is now more critical than ever to choose the optimal legal structure for your business to maximize tax efficiency.

But income taxes, while a key aspect of any business operation, are often not the sole determining factor in making the proper choice of entity. For example, liability protection or the ease of obtaining outside funding may drive the decision on entity choice. That said, while we reference these other important factors in the following discussion, our main focus remains the income tax consequences of various business entities and related tax planning opportunities for individuals. Also, our analysis focuses on federal tax rules; differing state tax treatment should also be considered.

In the current tax environment, several TCJA provisions can provide oversized tax benefits for business owners.

Post-TCJA Taxation of Business Income

In the current tax environment, several TCJA provisions can provide oversized tax benefits for business owners. Here are the highlights, and we discuss them in greater detail in the pages that follow:

- TCJA reduced the tax rate for C corporations from 35% to 21%; this represents a 40% reduction in the top rate. C corporation income remains subject to two levels of tax when distributed to shareholders.

- The tax treatment of qualified small business stock (QSBS) is especially generous. On disposition of QSBS, taxpayers can exclude from income the greater of $10 million or 10 times their tax cost basis in the shares. Only C corporation shareholders are eligible for QSBS treatment.

- Newly enacted code Section 199A provides a deduction of up to 20% of qualified business income (QBI) generated from a pass-through entity to its noncorporate members/shareholders. This effectively reduces the top rate on this income from 37% to 29.6%.

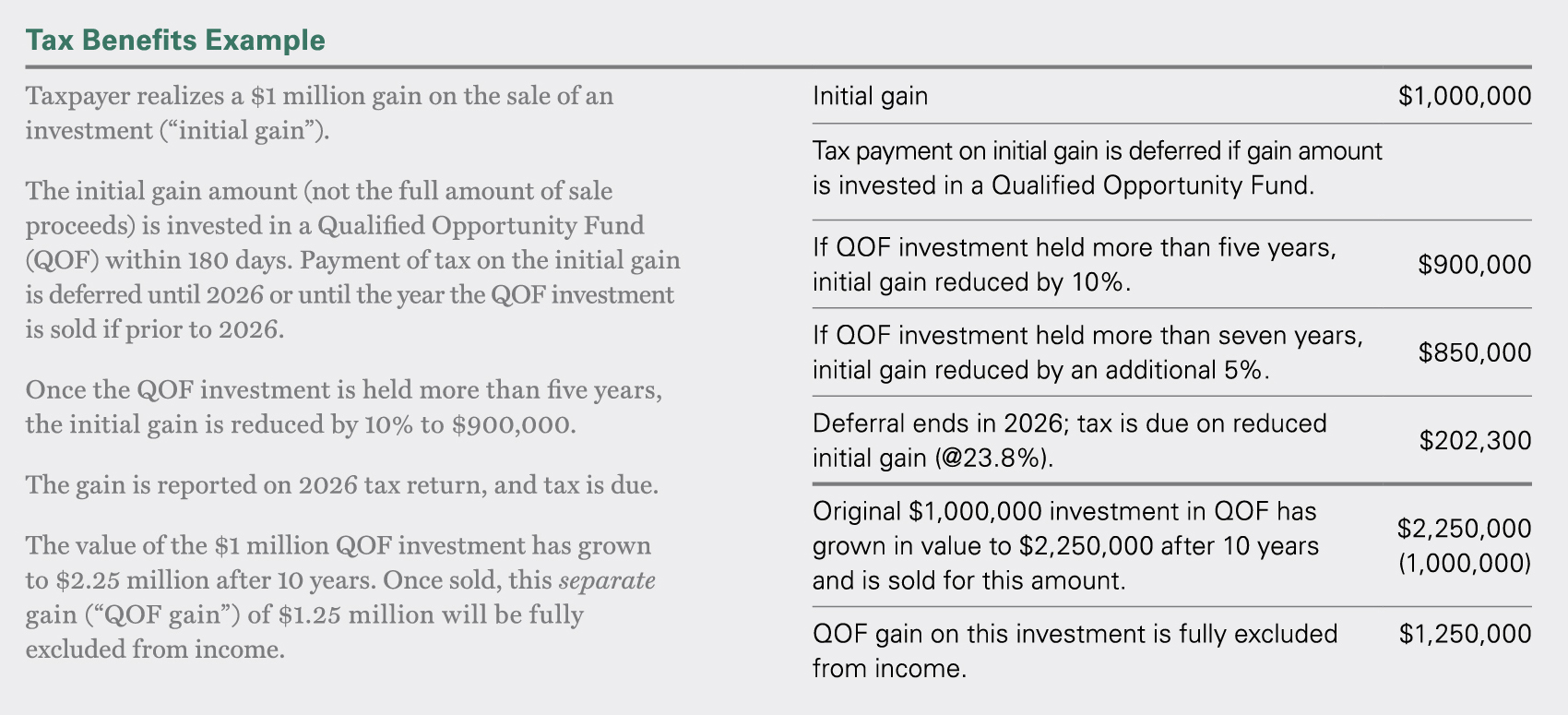

- A new provision called Qualified Opportunity Funds (QOFs) creates significant tax benefits for specified investments. These include a 10% reduction in gain amounts invested in QOFs along with a deferral of tax payment on the gain until 2026. A full exclusion of gain on the underlying QOF investment is also available if a 10-year holding period is met.

In the following sections, we take a closer look at these provisions, highlighting the types of business entities that may qualify and identifying several scenarios where significant tax benefits may result.

The Various Business Entities

There are several distinct types of business entities, each with unique ownership rules and tax treatments. In this A Closer Look, we consider the following commonly used entities:

Sole Proprietorship

- Single owner

- Business income or loss reported on individual tax return (Form 1040)

Partnership

- Two or more owners

- Separate tax return filed for partnership (Form 1065)

- Business income or losses pass through to owners on Schedule K-1

Limited Liability Company (LLC)

- One or more owners

- Separate tax return filed for LLC (Form 1065) – may not be required for single-member LLCs

- Business income or losses pass through to owners on Schedule K-1

C Corporation (C Corp)

- One or more owners

- Separate tax return filed for C corp (Form 1120)

- Business income is subject to tax at the C corp level

- Corporate earnings distributed to individual or trust shareholders reported as dividends on Form 1040 or 1041 and subject to a second level of tax

S Corporation (S Corp)

- One or more owners, but not more than 100, and all must be U.S. citizens or specified trusts

- Separate tax return filed for S corp (Form 1120S)

- Business income or losses pass through to individual shareholders on Schedule K-1 and are reported on Form 1040 or 1041 if trust is a shareholder

Reduced Tax Rate on C Corp Income

The reduction in C corp tax rate from 35% to 21% was the most consequential provision in TCJA. Unlike the individual tax changes, which are set to sunset after 2025, the new corporate rate has no expiration date, so it will remain in effect unless changed by future tax legislation. This change has shifted conventional thinking about the choice of business entity.

In the past, the prospect of double taxation of business income was quite unappealing to business owners. The top corporate rate of 35% significantly eroded the income that could be paid out to shareholders. A further tax of 23.8% on income distributed as dividends created a total tax burden of slightly more than 50%. This was much higher than the top individual rate of 39.6% paid on business income earned through a partnership or other flow-through entity.

Under TCJA, the calculus is quite different. The total combined rate on C corp income distributed to shareholders as dividends is now slightly less than 40%, much closer to the top rate of 37% on flow-through income. Moreover, if corporate income is not distributed, but is instead retained and reinvested to grow the business, the total annual tax burden is limited to 21%. Of course, the increase in corporate value from the reinvestment of income is likely to be subject to tax at some time in the future, either when dividends are paid or the stock is sold. However, if the business plan envisions little or no dividend distributions, the C corp structure can now be quite attractive.

The gain on the sale of QSBS can be fully excluded from taxable income.

Qualified Small Business Stock (QSBS)

Another compelling tax benefit applies to C corp shareholders who meet the requirements for QSBS. The gain on the sale of QSBS can be fully excluded from taxable income. The amount of excludible gain is limited to the larger of $10 million or 10 times the shareholder’s tax basis in QSBS.

Not all small businesses qualify, and not all individuals and entities can take advantage of the QSBS gain exclusion. Six main requirements must be met:

- Issuers of QSBS must be domestic C corporations, and QSBS shareholders cannot be C corporations. Also, certain specified corporations, such as real estate investment trusts (REITs) and regulated investment companies (RICs), will not qualify for QSBS treatment.

- A five-year holding period applies. To qualify for QSBS gain exclusion, stock must be held for more than five years.

- QSBS must be acquired directly from the corporation as part of an initial issuance. This can take place directly through the corporation or an underwriter in exchange for money or property, or as compensation for services provided to the corporation.

- The stock must have been issued after August 10, 1993, and the corporation’s aggregate gross assets since 1993 must never have exceeded $50 million prior to and immediately after stock acquisition.

- The corporation must meet an active business requirement during the holding period. To meet this test, at least 80% of the corporation’s assets must be used by the corporation in the active conduct of a trade or business.

- Certain businesses will not qualify. These include services in the fields of health, law, engineering, consulting, or financial services as well as hotel, restaurant, oil and gas, banking, investment, farming, and other specified business activities.

A Note on Excess Business Losses and Net Operating Losses

Under TCJA, a yearly cap of $250,000 ($500,000 if married filing jointly) was imposed on the deductibility of business losses used to offset nonbusiness income. Losses beyond this amount were converted into a net operating loss that could only be carried forward and could offset a maximum of 80% of taxable income.

The newly enacted CARES Act removes the business loss deductibility restriction retroactively to January 1, 2018, through 2020. Taxpayers who were affected by the limitation on excess business losses in 2018 (and 2019 if returns have been filed) should consider filing amended returns to claim tax refunds.

The CARES Act also made two significant temporary changes to the rules governing net operating losses:

- Net operating losses incurred from 2018 through 2020 can now be carried back for up to five years.

- Net operating losses may offset up to 100% of taxable income for any year prior to 2021.

These changes apply through 2020, unless extended further by legislation.

The combination of the new reduced corporate income tax rate with the ability to exclude gain on the sale of QSBS provides the potential for exceptional tax results with the C corp form of business.

How can this work? Imagine a new qualified small business that produces steadily increasing profits that are taxed at a top rate of 21%. Instead of distributing the profits as dividends and facing a second level of tax, the owner reinvests these amounts back into the business, adding to its growth. At some point more than five years in the future, the C corp shares are sold for a handsome profit. This gain is then fully excluded from taxation as QSBS. From a tax standpoint, it would be difficult to conceive of a more beneficial scenario.

While the tax benefits for the C corp entity choice can indeed be attractive, a new provision added by TCJA greatly enhances the tax results for business income earned by pass-through entities, as discussed below.

The pass-through form of business entity can produce singular tax results for businesses that qualify for the full 20% QBI deduction.

20% Deduction for Qualified Business Income (QBI)

Internal Revenue Code Section 199A provides a significant benefit for individuals and certain trusts and estates that receive business income through a sole proprietorship, partnership, LLC, S corporation, or other relevant pass-through entity. A deduction of up to 20% of the combined qualified business income is allowed. Similarly, it is allowed for qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

The deduction creates a top effective tax rate of 29.6% on qualified business income, a 20% reduction to the current 37% rate. It is not an itemized deduction, so it will be allowed even for taxpayers who do not itemize deductions.

QBI is defined as income earned from any trade or business other than that of performing services as an employee. Beyond specified income levels, certain restrictions and limitations on the deduction will apply.

For tax year 2020, single taxpayers with adjusted gross income of more than $163,300 and married taxpayers filing jointly with adjusted gross income of more than $326,600:

- No deduction is allowed for income from specified service trades or businesses (SSTBs). These include health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, investing and investment management, trading, dealing with securities, or a trade or business where the principal asset is the reputation or skill of one or more of its employees or owners.

- The deduction will only be allowed for QBI that exceeds the greater of (a) 50% of W-2 wages paid with respect to the trade or business or (b) the total of 25% of W-2 wages plus 2.5% of the unadjusted basis immediately after acquisition of qualified property with respect to the trade or business.

Section 199A was included in TCJA in an effort to level the playing field for income earned by C corps and income earned by pass-through entities, including sole proprietorships. At 29.6%, the top effective rate is still much higher than the top rate of 21% on C corp income, but with pass-through entities, there is no second level of tax when profits are distributed to business owners. Note that Section 199A is scheduled to expire at the end of 2025.

The pass-through form of business entity can produce singular tax results for businesses that qualify for the full 20% QBI deduction. Additionally, where the business operations result in a loss, perhaps in the early years of operation, the loss will pass through to the business owner and is reported on their individual tax return. This loss may be available to offset other current taxable income, producing a tax benefit of up to 37%.

Our final discussion point involves a TCJA tax-driven program that is available for both C corps and pass-through entities, but not sole proprietorships.

Although the tax benefits involved are clearly attractive, our investment team has advised caution in considering long-term investments in a Qualified Opportunity Fund.

Qualified Opportunity Funds

This new investment program was designed to spur economic development and job creation in distressed communities. It provides investors with significant tax incentives to reinvest capital gains realized from the sale of an investment (as distinguished from the full proceeds) into Opportunity Zones. There are more than 8,700 designated Opportunity Zones in all 50 states; each state has at least 25 such zones.

The vehicle used to make the investments is a Qualified Opportunity Fund (QOF), which must be formed as a corporation or partnership. A broad class of investments will qualify, including commercial and industrial real estate, housing, infrastructure, and current or start-up enterprises. Numerous other rules address timing of investments, percentages of assets invested, required test periods, and potential penalties.

The investment must be made within a 180-day period after the initial gain is recognized, and the tax benefits provided are significant. It is important to remember that tax benefits apply to two separate and distinct gains: the initial gain and the QOF gain.

Tax deferral. Investors can invest the proceeds from a current recognized gain (initial gain) into a QOF. This initial gain will not be subject to tax until the end of 2026 or when the investment is sold or otherwise disposed of, if earlier.

Tax reduction. Tax on the initial gain will be reduced by 10% if the QOF investment is held more than five years. For investments made prior to 2020, a further 5% reduction is available if the QOF investment is held more than seven years.

Gain exclusion. If the QOF investment is held more than 10 years, the separate gain on this investment (QOF gain) is fully excluded from income. This treatment is similar to the QSBS scenario, but the required holding period is twice as long.

As noted above, a C corp can qualify as a QOF and can also qualify as QSBS. In certain limited situations, it may be possible to attain the tax benefits of both combined in the same investment. If the facts align correctly, in 2020 an investor could conceivably:

- Invest a current gain (initial gain) into C corporation stock that qualifies as a QOF and as QSBS

- Reduce the amount of the initial gain by 10% under the QOF provisions by holding the stock until 2026

- Defer the taxation of the reduced initial gain until 2026 under the QOF provisions

- Sell the QOF/QSBS after holding it for six years and exclude the gain as QSBS (this is shorter than the 10-year holding period for excluding the gain under the QOF provisions)

Although the tax benefits involved are clearly attractive, our investment team has advised caution in considering long-term investments in a QOF. This program is quite new, there is risk to principal, and manager due diligence is essential.

Changing the Structure of an Existing Business

While it is clearly important to consider the proper business entity when embarking on a new business venture, some owners may wish to change the structure of an existing business to take advantage of the tax benefits described above. For example, changing the entity structure of a partnership into a C corp that qualifies as QSBS can be a very effective strategy. On the other hand, in some situations a C corp structure with the low corporate tax rate of 21% may now be preferable for a business currently operating as an LLC.

There are numerous factors to consider in such a decision:

Type of business. Will it qualify as QSBS, the 20% QBI deduction under Section 199A, or as a QOF?

Is the business currently generating profits or losses? If profits, how are they taxed? If losses, what tax benefits are being achieved?

Cash needs. Does the business owner need to distribute profits currently?

Exit strategy. Does the business owner intend to sell the business, and if so, what is the time frame?

Tax implications. Would the change in business structure be a taxable event?

- Converting from a C corp to a sole proprietorship or partnership may cause a tax liability at both the C corp and the shareholder level.

- Converting from a C corp to an S corp (or the reverse) would normally have minimal tax consequences, but may adversely affect QSBS eligibility.

- Converting from a sole proprietorship to a C corp or S corp would normally have minimal tax consequences.

- Converting from a partnership to a C corp or S corp may create a tax liability.

Tax law changes. Some changes enacted in TCJA are scheduled to expire at the end of 2025, and of course, the tax law is subject to change by new legislation at any time.

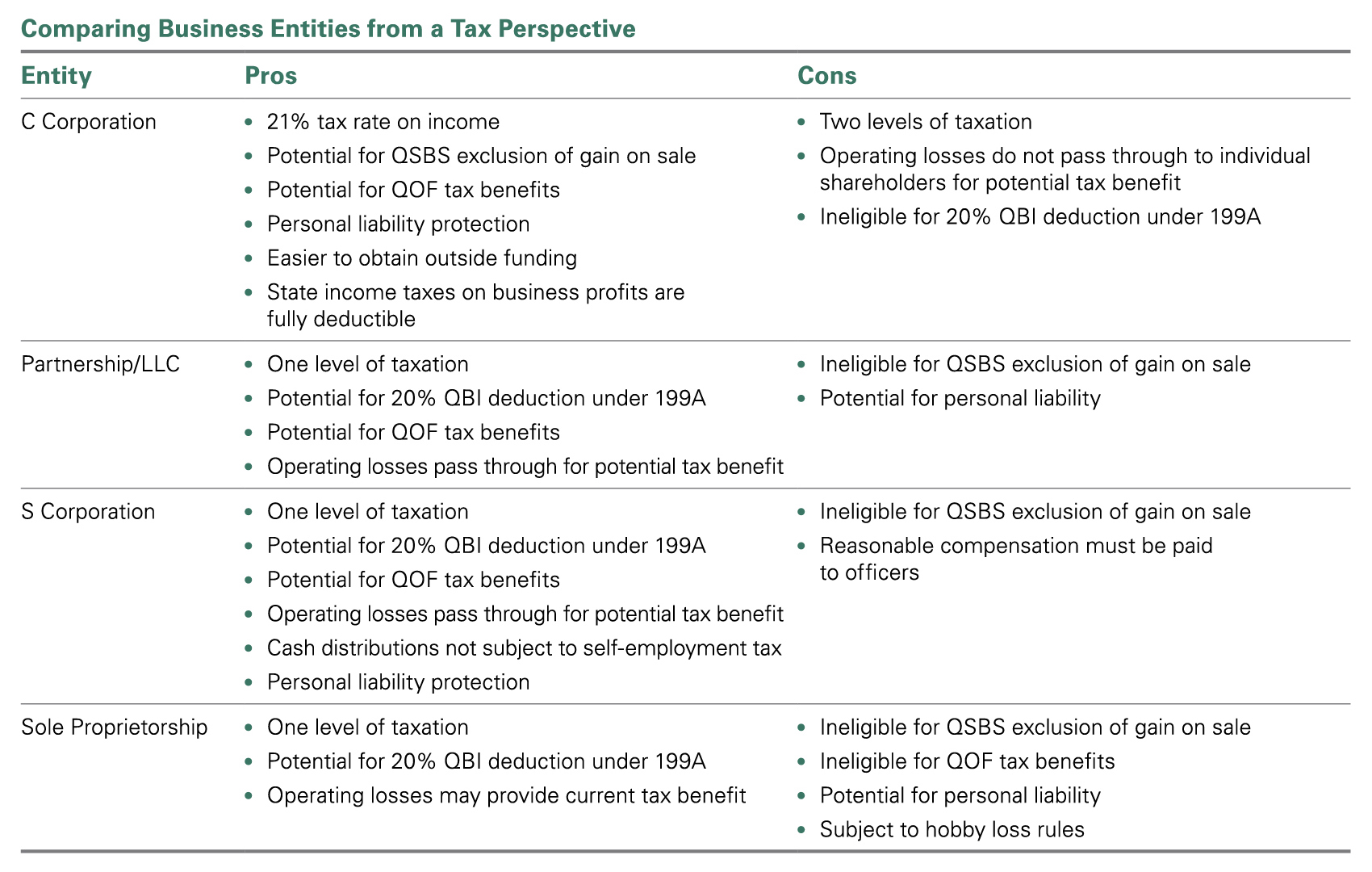

The table above summarizes the pros and cons of each business entity from a tax perspective.

Which Business Entity Makes Sense for Your Company?

Choosing the best type of business entity for your company is a critical decision that can affect how you are taxed, the personal liability risk you may incur, and your ability to raise money, among other important business considerations.

The optimal structure will depend on a careful assessment of multiple factors, including the type of business, whether you are expecting losses in the early years, and importantly, your ultimate plans for the business.

Your tax and legal advisors can help you determine the best choice, and we are happy to be involved in the discussion. We have seen many clients enjoy very favorable tax results through QSBS and the other tax provisions detailed above.

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth, corporate profitability, geopolitical conditions, and inflation. Bessemer Trust or its clients may have investments in the securities discussed herein, and this material does not constitute an investment recommendation by Bessemer Trust or an offering of such securities, and our view of these holdings may change at any time based on stock price movements, new research conclusions, or changes in risk preference.