Types and Uses of Trusts

A brief survey of the two basic trust structures, their advantages, and other considerations.

Purpose and Structure

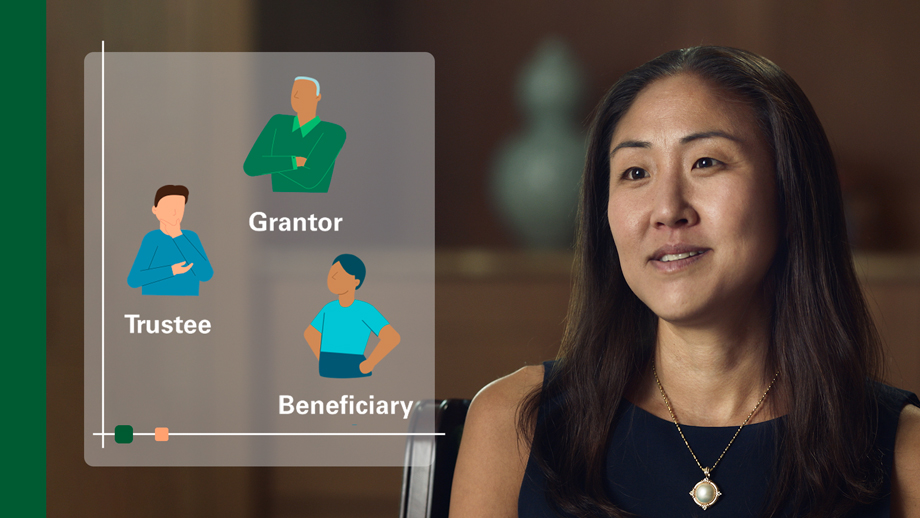

- A trust is a legal arrangement by which an individual (the “Grantor” or the “Settlor”) transfers assets to a trustee with directions on how to manage the assets for the benefit of the trust beneficiaries. Typically, the trustee’s responsibilities will include managing the investment of the assets held in trust and making distributions of trust assets to the beneficiaries. Trusts can be helpful, for example, in situations in which beneficiaries lack fiscal responsibility or expertise to ensure that assets held for their benefit are prudently managed.

- A revocable trust may be altered, amended, or completely cancelled (revoked) by the Grantor, who is taxed on the trust’s income as if the trust does not exist. The trust’s assets will be included in the Grantor’s taxable estate. Customarily, the Grantor will act as sole trustee or co-trustee of his or her revocable trust during his or her lifetime.

- Irrevocable trusts cannot be altered, amended, or revoked by the Grantor. The trust’s assets are typically excluded from the Grantor’s taxable estate on his/her death.

- A trust may be created during the Settlor’s lifetime or under the terms of a Settlor’s will at the Settlor’s death (which is called a “testamentary trust”).

Advantages

- Flexible trust structures can be implemented that accommodate changing circumstances occurring in the future.

- Trusts can be particularly useful for transfers to young children, elderly parents, or other family members who are not fully able to manage assets.

- Trusts may last for the lifetime of beneficiaries or may terminate on specified events (such as when the beneficiary reaches a certain age).

- Trusts may control who will receive the trust assets at the beneficiary’s death (if the trust lasts for the beneficiary’s life or if the beneficiary dies before the trust terminates).

- Revocable trusts may offer additional benefits (a) in the event of incapacity of the Grantor, (b) with respect to the need for probate at the Grantor’s death, and (c) with respect to the level of privacy afforded to the family at the death of the Grantor.

- Irrevocable trusts may be used to protect a beneficiary from future creditors.

- Irrevocable trusts may also avoid certain federal and state taxes at the beneficiary’s death.

Other Considerations

- The generation-skipping transfer tax is a flat tax imposed at the highest federal estate tax rate (40% in 2022) in addition to gift or estate tax on transfers made during life or upon death to a “skip” person, typically a grandchild or great-grandchild. The available exemption ($11.06 million for 2022) may be leveraged to pass substantial assets in continuing trust for younger generations.

This summary is for your general information. The discussion of any estate planning alternatives and other observations herein are not intended as legal or tax advice and do not take into account the particular estate planning objectives, financial situation, or needs of individual clients. This summary is based upon information obtained from various sources that Bessemer believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in law, regulation, interest rates, and inflation.